|

|

|

|

Accounting Standards for Private Enterprises (ASPE)

DIFFERENCE BETWEEN PERPETUAL AND PERIODIC INVENTORY SYSTEMS

|

One question that my students ask very often is about the difference between perpetual and periodic inventory systems. Businesses chose to use either of the systems depending on their strategic goals and managerial needs; however each system has a different impact on accounting. To explain these differences, I provided you with an example with two scenarios. Scenario 1 demonstrates the use of the perpetual inventory system, and scenario 2, the use of a periodic system

|

|

Example:

Company ABC is a newly created company specialized in the wholesale of small vehicles tires. It started operating on June 1, 2017 and its year-end is December 31, 2017. The cost of inventories is determined on a first-in, first-out basis. The following is a list of transactions (purchases and sales only) occurred between June 1 and December 31, 2017:

| June 1 |

purchase of 100 tires from Belvic Canada Inc. for $4,000. Invoice terms are 2/10, n/30. |

| July 5 |

purchase of 120 tires from Dustroff Inc. for $4,560. Invoice terms are 2/10, n/30. |

| July 20 |

sale of 60 tires to Flextire Ltd. for $4,920. Invoice terms are n/30. |

| August 2 |

purchase of 150 tires from Belvic Canada Inc. for $5,250. Invoice terms are 2/10, n/30. |

| September 16 |

sale of 82 tires to Kim’s Garage for $6,888. Invoice terms are n/30. |

| October 22 |

sale of 148 tires to Tires Ready Ltd. for $11,840. Invoice terms are n/30 |

| December 7 |

purchase of 200 tires from Velfor Industris Inc. for $6,400. Invoice terms are 1/10, n/30. |

|

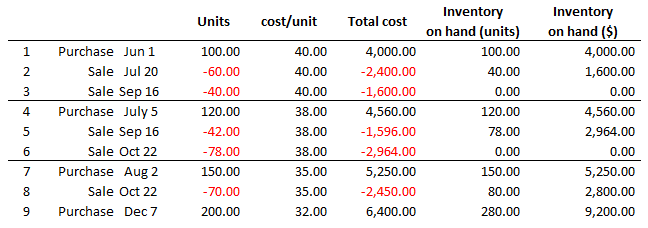

Remember that the cost of inventory is determined on a first-in, first-out basis, so let’s prepare a table to track the cost of goods sold, quantities and cost of inventory on hand.

TABLE 1-1

|

The following is a comparison between the journal entries recorded by Company ABC during 2017 in each of the two scenarios:

TABLE 1-2

| Entry Date

|

Scenario #1

Perpetual inventory System

|

Scenario #2

Periodic inventory System

|

| Purchase - June 1

|

| Inventory – Tires |

4,000 |

| Accounts payable |

4,000 |

|

| Purchases – Tires |

4,000 |

| Accounts payable |

4,000 |

|

| Purchase - July 5

|

| Inventory – Tires |

4,560 |

| Accounts payable |

4,560 |

|

| Purchases – Tires |

4,560 |

| Accounts payable |

4,560 |

|

|

For purchases, the difference consists in the debited account. When using the perpetual system, we need to update inventory on hand every time we make a new purchase, so we debit the inventory account, which is a current asset account. For the periodic system, we debit the purchases account instead, which is an expense account.

|

| Sale - July 20

|

| Bank |

4,920 |

| Sales – Tires |

4,920 |

| Cost of Goods sold |

2,400 |

| Inventory – Tires |

2,400 |

| Cost of goods sold = $2,400, see table 1-1, second line

|

|

| Bank |

4,920 |

| Sales – Tires |

4,920 |

|

|

For sales, the difference consists in two additional lines we add for the perpetual system. With each sale, we need to update cost of sales and inventory accounts. The idea is to remove from inventory, the cost of those units that we sold and record the amount as cost of sales. For the periodic inventory, we simply record the sale without updating the inventory and COGS.

|

| Purchase - August 2

|

| Inventory – Tires |

5,250 |

| Accounts payable |

5,250 |

|

| Purchases – Tires |

5,250 |

| Accounts payable |

5,250 |

|

| Sale - September 16

|

| Bank |

6,888 |

| Sales – Tires |

6,888 |

| Cost of Goods sold |

3,196 |

| Inventory – Tires |

3,196 |

Cost of goods sold = $1,600 + $1,596 = $3,196, see table 1-1

3rd line + 5th line.

|

|

| Bank |

6,888 |

| Sales – Tires |

6,888 |

|

| Sale - October 22

|

| Bank |

11,840 |

| Sales – Tires |

11,840 |

| Cost of Goods sold |

5,414 |

| Inventory – Tires |

5,414 |

Cost of goods sold = $2,964 + $2,450 = $5,414, see table 1-1

6th line + 8th line.

|

|

| Bank |

11,840 |

| Sales – Tires |

11,840 |

|

| Purchase - December 7

|

| Inventory – Tires |

6,400 |

| Accounts payable |

6,400 |

|

| Purchases – Tires |

6,400 |

| Accounts payable |

6,400 |

|

| Let’s summarize the above transactions using the T accounts

|

| Inventory - Tires

|

| Jun 1 |

4,000 |

|

|

| Jul 5 |

4,560 |

|

|

|

|

2,400 |

July 20 |

| Aug 2 |

4,250 |

|

|

|

|

3,196 |

Sep 16 |

|

|

5,414 |

Oct 22 |

| Dec 7 |

6,400 |

|

|

| Dec 31 |

9,200 |

|

|

|

|

|

|

| Cost of Goods Sold

|

| Jul 20 |

2,400 |

|

|

| Sep 16 |

3,196 |

|

|

| Oct 16 |

5,414 |

|

|

| Dec 31 |

11,011 |

|

|

|

|

|

|

|

| Inventory - Tires

|

|

0 |

|

|

| Dec 31 |

0 |

|

|

|

|

|

|

| Purchases - Tires

|

| Jun 1 |

4,000 |

|

|

| Jul 5 |

4,560 |

|

|

| Aug 2 |

5,250 |

|

|

| Dec 7 |

6,400 |

|

|

| Dec 31 |

20,210 |

|

|

|

|

|

|

|

|

Notice that when using the perpetual inventory system, we are able to track inventory at all times because we update inventory following each purchase and each sale; therefore, the account balances for inventory and Cost of Goods are accurate and do not need any adjustment at year-end. However, when using the periodic system, we don’t need to update inventory and we record all purchases as expenses. As we mentioned above, 280 units remain in inventory at December 31, 2017, with a total cost of $9,200; however, the balance in the Inventory account remain $0. So, when using the periodic system, we need to do an inventory count at year-end and record an additional journal entry to adjust inventory and cost of purchases accounts to actual:

|

| Year-end adjustment - Dec 31

|

|

| Inventory – Tires |

9,200 |

| Purchases – Tires |

9,200 |

|

|

|

Here is a summary of the differences between the two systems:

TABLE 1-3

|

Perpetual

Inventory System

|

Periodic

Inventory System

|

| Quantity and cost of inventory

|

Easily determined at all the times because the inventory is updated following each purchase, sale, and other inventory related transactions. Occasionally, an inventory count is done to ensure inventory records are accurate and adjust for any discrepancies.

|

Determined only after doing the inventory count. When using the periodic system, we don’t track the inventory on hand, so to determine the quantities and cost of inventory on hand at any point in time, we need to do an inventory count.

|

| Record keeping

|

Requires more record keeping given that the inventory and cost of goods accounts are constantly updated.

|

Less journal entries are required given that neither the inventory account nor the cost of goods account is updated.

|

| Use

|

Used mostly by large businesses except when the inventory is small and can easily be determined without using the perpetual system.

The perpetual system helps management to make better decisions by keeping optimal quantities of inventories; therefore, avoiding overstocking and understocking costs.

|

Generally, used by small businesses due to lack resources and staff.

Because quantities on hand are determined only when performing occasional inventory counts, it is harder for management to keep optimal quantities of inventory on hand. As a result, businesses are likely to incur additional costs due to overstocking and understocking.

|

|

|

|