Example:

Company ABC is a newly created company specialized in the retail business of one product, flat screen televisions, Bix Model 500. The company uses the perpetual method of inventory to account for its inventories, and its year end is December 31, 2018. On 1 October 2018, Company ABC purchased 10 televisions for $2,000 ($200 each). Here is the journal entry that was recorded by Company ABC in its books:

| Inventory – Televisions |

2,000 |

| Bank |

2,000 |

On November 15, 2018, The Company sold 2 televisions for $320 each. Here is the journal entry that was recorded by Company ABC in its books:

| Bank |

640 |

| Cost of Sales |

400 |

| Sales - Televisions |

640 |

| Inventory – Televisions |

400 |

- Sales = $320 x 2 units = $640

- Cost of sales = $200 x 2 units = $400

|

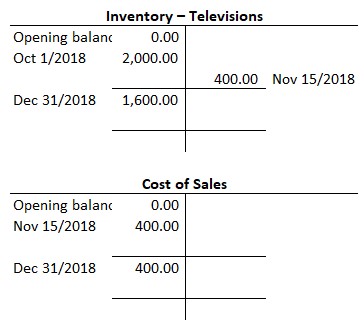

For the sake of simplicity, let’s assume that no other transactions occurred during 2018. Here are the account balances for Inventory and Cost of sales using the T account:

Scenario# 1

Suppose that on December 31, television selling prices have declined. The Bix Model 500 television retail price per unit dropped from $320 to $180, and the estimated cost to be incurred to make the sale is $10 per television.

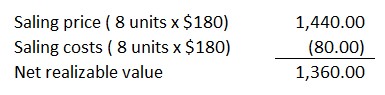

As of December 31, 2018, 8 units remain in inventory, so the cost of inventory on hand is $1,600 (8 units x $200). Let’s determine the net realizable value for these 8 units:

Conclusion

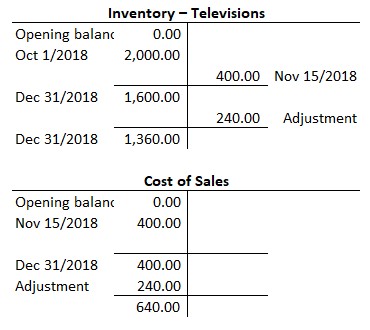

The net realizable value of $1,360, is lower than the cost of $1,600. We can conclude that the cost of inventories may not be recoverable. In this case, the inventory should be written down to adjust it to the net realizable value of $1,360 by recording the following entry:

| Cost of Sales |

240 |

| Inventory – Televisions |

240 |

- Adjustment = $1,600 - 1,360 = $240

|

Here are the general leger balances of inventories and cost of sales accounts after the adjustment:

Accordingly, the carrying amount of inventories presented on the balance sheet is now $1,360.

Scenario# 2

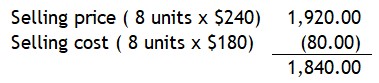

Suppose that on December 31, television selling prices have declined. The Bix Model 500 television retail price dropped from $320 to $240, and the estimated cost to be incurred to make the sale is $10 per television.

Let’s determine the net realizable value for these 8 units:

Conclusion

This time, the cost of $1,600 is lower than the net realizable value of $1,840. No need for an adjustment. The carrying amount of inventories on the balance sheet remains $1,600.